Accounting

5 Ways Accountants Can Use AI Right Now

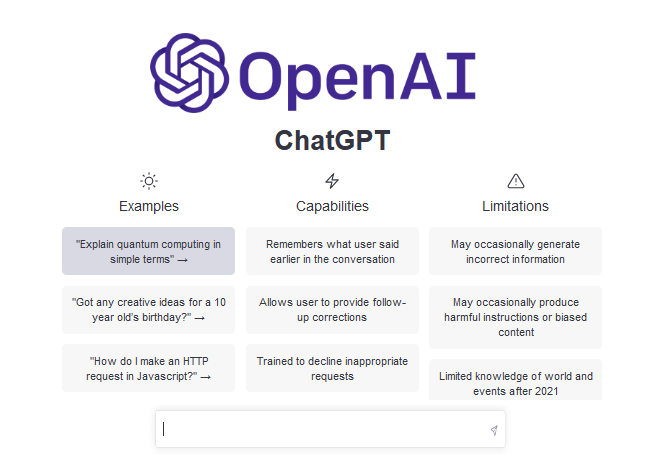

According to a UBS Study, ChatGPT reached 100 million monthly active users two months after its launch in January, making it the fastest-growing consumer application in history.

Aug. 22, 2023

By Andrew Antos.

According to a UBS Study, ChatGPT reached 100 million monthly active users two months after its launch in January, making it the fastest-growing consumer application in history.

Businesses are still working through how to make this record-breaking consumer application relevant and lucrative for the enterprise and for industries such as accounting, heavy with administrative-filled, repetitive, number crunching processes, ChatGPT is turning out to be a game changer.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more...

Already registered? Login

Need more information? Read the FAQ's

According to the Mordor Intelligence Statistics Report, AI in the accounting industry is projected to grow 30% year on year until 2027. One of the biggest ways AI and ChatGPT will help accounting companies is cutting down on manual, administrative tasks currently performed by employees and reducing overall costs. In fact, Accenture Consulting predicts that AI advancements within accounting will help companies cut costs by up to 80%, while reducing the amount of time employees spend on administrative tasks by between 80-90%.

Breaking it down further here are six concrete ways that ChatGPT and GenAI can already help accounting teams perform processes much more efficiently and accurately:

Order Management

No. 1 objective for every accounting team is to have accurate and complete data on each transaction – Start Dates, End Dates, Payment Terms, etc. That’s why Order Management teams spend a lot of time reconciling data in CRM/ERP against the customer contract. LLM-powered Software can automatically read customer contracts and match information in signed sales documents to those like Salesforce and NetSuite, monitoring for inconsistencies so that they can be flagged to the right person and immediately addressed. AI then drives faster and more accurate order processing, invoicing and downstream processes while lowering overhead cost.

Quote/Purchase Order Matching

Billing teams for enterprise businesses match Order Forms signed with a customer or partner against a Purchase Order received from the customer against the Order Form. Since an invoice that does not match the received Purchase Order gets rejected by the customer, this can lead to cash flow issues. This typically includes reconciling simple, but time consuming, fields like Bill To and Ship to Addresses, Start Dates, End Dates, Product Tables, Payment Terms, Billing Frequencies and Total Contract Values.

The advanced reasoning capabilities of GenAI models enable billing teams to automate matching between documents (Order Form / Purchase Order) and/or document against system data (Salesforce CPQ fields / Purchase Order).

ASC 606 Assurance & Audit

Most revenue accounting teams struggle to get sufficient ASC 606 review coverage on their customer contract population. This results in an amount of risk that can result in a material misstatement in their financial statements. Large Language Model-enabled software allows companies to read 100% of their customer contracts, surface non-standard terms from an ASC 606 perspective and generate ASC 606 accounting memos for audit. GenAI thus allows revenue accounting teams to achieve a higher level of comfort with their financial statements.

ASC 842 Lease Abstraction

Almost every company has a number of leases that need to be accounted for under the ASC 842 accounting standard. In this case, technical accounting teams either internally or using offshoring services start by abstracting metadata and relevant terms from leases, so they can perform the actual accounting work in a dedicated lease accounting software. Given that leases are never standardized, offshoring typically leads to a low abstraction accuracy and slow turnaround time. Large Language Model-powered Software helps accounting teams perform a highly accurate and instant data abstraction and then push metadata/non-standard terms directly into a dedicated lease accounting software.

Procurement

Generative AI can assist accounting teams in procurement and HR functions by automating and streamlining processes, reducing manual effort, and improving accuracy. Some specific use cases include:

Expense Management: Generative AI can automate how teams extract and categorize expense data from receipts and invoices. This use case streamlines the expense reporting process, reduces errors likely to come up in manual reviews, and enables faster reimbursement.

Vendor Invoice Processing: Missing invoice details and payment information is more trouble than what it’s worth. Generative AI can flag and help fill in those gaps. It can analyze and process vendor invoices, extracting key invoice details such as invoice numbers, amounts, and due dates. This automation improves efficiency, reduces manual data entry, and minimizes the risk of errors.

The power of Generative AI is not limited to these five examples alone. Its potential is limitless and we are just scratching the surface on how it can revolutionize how accounting teams work. Whether by partial or full adoption, generative AI can help these teams shift their effort and knowledge power toward more complex projects, improve accuracy and efficiency on tasks handled through generative AI, enhance customer support, and uncover valuable insights from unstructured data. However, while generative AI can automate certain processes, human oversight and expertise will always be crucial in ensuring accuracy, compliance, and strategic decision-making.

=======

Andrew Antos is the founder and CEO of Klarity.